Explain Different Types of Audit Risk

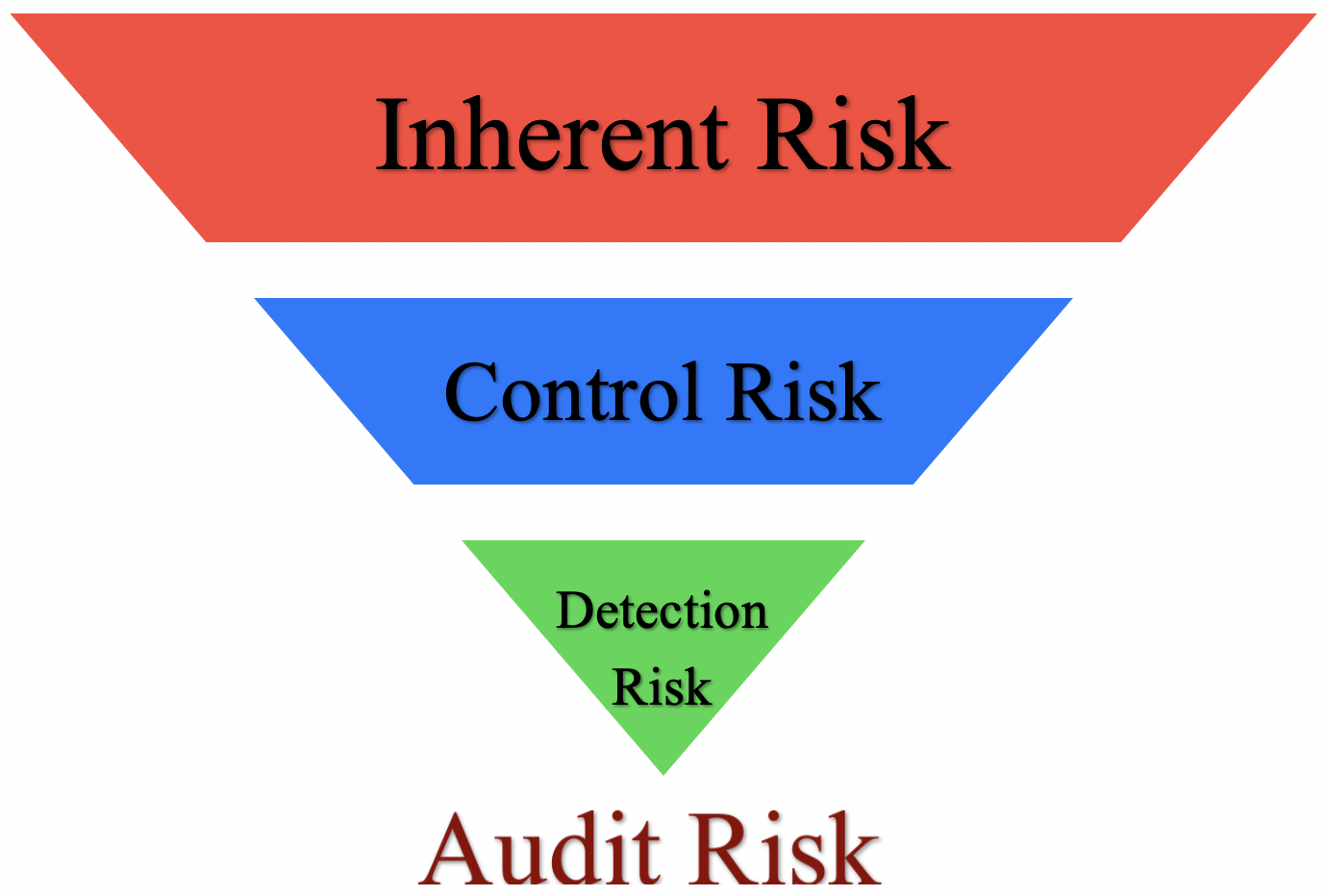

In the context of an audit this is a risk of misstatements in the audit itself. Detection risk control risk and risk of material misstatement.

9 Different Types Of Audits Internal External Financial More

Inherent risk is risk that financial statements are misstated before internal control are put in place.

. For example transactions that arent verified. Audit risk is made by three types of risk which are inherent risk control risk and detection risk. Risk is inherent in every business process and transaction.

Types of Audit Risk. An external audit can be done by financial institutions or government agencies. Companies implement internal controls to.

Detection risk is the threat that the auditor will not detect a miscalculation or misstatement. An auditing teams primary goal is to assure the audited companys stakeholders that its financial documents contain accurate information which is essential because these documents often influence economic decisions. Types of Audit Risks There are three primary types of audit risks namely inherent risks detection risks and control risks.

The audit risk model expresses the relationship between the audit risk components as follows. Audit Risk Inherent Risk x Control Risk x Detection Risk. Types of Audit Risk The two components of audit risk are the risk of material misstatement and detection risk.

010 060 x 060 x Detection Risk. Risk of fraud and theft. To illustrate the use of the model lets assume that the auditor has.

Inherent risk is caused by nature of balance or transaction or the nature of entitys business. Clients and Auditors themselves. Its the reason internal controls must be established.

Auditors must follow the GAAS or the Generally Accepted Auditing Standards. The model can be used to determine the planned detection risk for an assertion. Audit firm in Singapore briefs their auditors on these risks to ensure that they dont fall victim as this could spoil the reputation and the business valuation of the firm.

Audit risk therefore includes any factors that may cause a material misstatement or omission in the financial statements. Here is the list of 14 Types of Audits and Level of Assurance. Following are the Top 3 Types.

Inherent risk is the risk that the financial statements may contain material misstatement before considering any internal control procedure. There are three audit risk components which include. Below are the types of audit risks.

Below are the different types of audit. Detection Risk 0333. The symbols represent audit inherent control and detection risk respectively.

There are three common types of audit risks which are detection risks control risks and inherent risks. Other Audit Risks The other two components of audit risk are control risk and detection risk. Detection risks This means that the auditor fails to detect the misstatements and errors in the companys financial statement and as a result.

Inherent risks detection risks and control risks. Inherent Risks An inherent risk is the type of audit risk that cannot be identified by a companys internal auditors or other financial officers. Total audit risk is the product of below three types of risks.

The risks are classified into three different types. Audit risks come from two main different sources. The audit risk model is best applied during the planning stage and possesses little value in terms of evaluating audit performance.

Different types of audit. Inherent Risk An inherent risk is the risk of material misstatements due to fraud or incompetence. Risk elements are 1 inherent risk 2 control risk 3 acceptable audit risk and 4 detection risk.

The three types of audit risk are inherent risk control risk and detection risk. 3 Detection Risks. Control risk measures the possibility of material financial misstatements because of internal control failure.

Assume for example that a large sporting goods store needs an audit performed and. Detection Risk 33. What is the definition of audit risk.

There are three main types of audit risk. The following are the basic types of audit risk. The external audit is performed by people who are not associated with your business in any way.

AR IR x CR x DR. There are many types of audits including financial audit operational audit statutory audit compliance audit and so on. Control Risk The risk that internal controls are missing or fail.

Whereas business risks relate to the organization and its stakeholders audit risk. Inherent risk and control risk combined is also known as the risk of material misstatement which is the risk that the financial statements of a company are materially misstatement before the audit. The inherent risk is one of the 3 types of audit risk.

Audit risk is the risk that the auditor expresses an inappropriate audit opinion on the financial statements. Audit Risk is calculated using the formula given below. Audit Risk IR x CR x DR.

If inherent risk and control risk are assumed to be 60 each detection risk has to be set at 278 in order to prevent the overall audit risk from exceeding 10. 010 05 x 06 x Detection Risk. We will discuss this in detail below.

Inherent risk control risk and detection risk are the components that make up audit risk. Inherent risks Control Risks and Detection Risks. This risk consists of three main components.

In this article we will explain the main 14 types of audits being performed in the current audit industry or practices. 1 Inherent Risks. The control risk for the audit may therefore be considered as high.

Inherent risk is the risk that could not be prevented due to uncontrollable factors and it is also not found in Audit. 2 Control Risks. Detection Risk 0103.

An audit risk model is a conceptual tool applied by auditors to evaluate and manage the overall risk encountered in performing an audit. An audit risk model is a tool that auditors use to evaluate and manage the potential risks associated with performing an audit.

3 Types Of Audit Risk Inherent Control And Detection Accountinguide

Comments

Post a Comment